pa educational improvement tax credit individuals

Pennsylvania provides tax credits for corporate contributions to Scholarship Organizations SOs -nonprofits that provide private school scholarships or Educational Improvement Organizations. Tom Wolf said Wednesday that he will veto a proposed expansion of Pennsylvanias Educational Improvement Tax Credit which directs millions of potential tax.

Get 90 Of Your Pa Taxes Back When You Help Students At Tcp The Common Place

162 funds given to.

. Enter the amount you are considering donating to CSFP. Donate at least 3500 in one check to the SPE. Educational Improvement Tax Credit EITC.

PA Tax Credit Net Federal Tax Reduction based on 21 of Net after PA Based on a 21 Tax Rate Cost to you Social Impact. This translates to a tax credit of 3150 which will be usedrefundable if donors Pennsylvania income is 102606 or higher. The Educational Improvement Tax Credit Program EITC provides a way for the businesses and individuals to be involved with education by directing their tax liability dollars to a school of.

The Trust for Public Land is honored to be a Pennsylvania Educational Improvement Tax Credit EITC non-profit participant. This credit will reduce their state tax liability on a dollar-for. The Educational Improvement Tax Credit EITC and Opportunity Scholarship Tax Credit OSTC programs provide tax credits to eligible individuals contributing to the Scholastic Opportunity.

Pennsylvania is a unique state that permits you to direct up. Individuals and businesses who participate in this program receive a state income tax credit equal to 90 of their donation. Payment to Educational Opportunities a special purpose entity which distributes funds to selected 501 c 3s.

The Educational Improvement Tax Credit Program EITC is a way for you to make a gift to Benchmark School go even further. As such qualified businesses and individuals who pay. Except for the Educational Improvement and Opportunity Scholarship Tax Credits married taxpayers who claim PA-40 Schedule OC tax credits must file separate returns even if both.

40000 Deduction of 40000 under IRC. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement. Schneider Downs is the 13th largest accounting firm in the Mid-Atlantic region and serves individuals and companies in Pennsylvania PA.

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

Eitc Ostc Holy Child School At Rosemont

Educational Improvement Tax Credits Eitc Archbishop Ryan High School

Support Body Spe Children S Village

Educational Improvement Tax Credit Program Catholic Diocese Of Pittsburgh Pittsburgh Pa

Educational Improvement Tax Credit Program Eitc Penn Mont Academy

Pennsylvania Educational Improvement Tax Credit Program Eitc Erie Catholic School System

Educational Improvement Tax Credit Passed Pa House Act To Stop It In The Senate Ministry Of Public Witness

Did You Know Educational Improvement Tax Credit Program Ymca Of Greater Brandywine

Eitc Spe Lititz Christian School

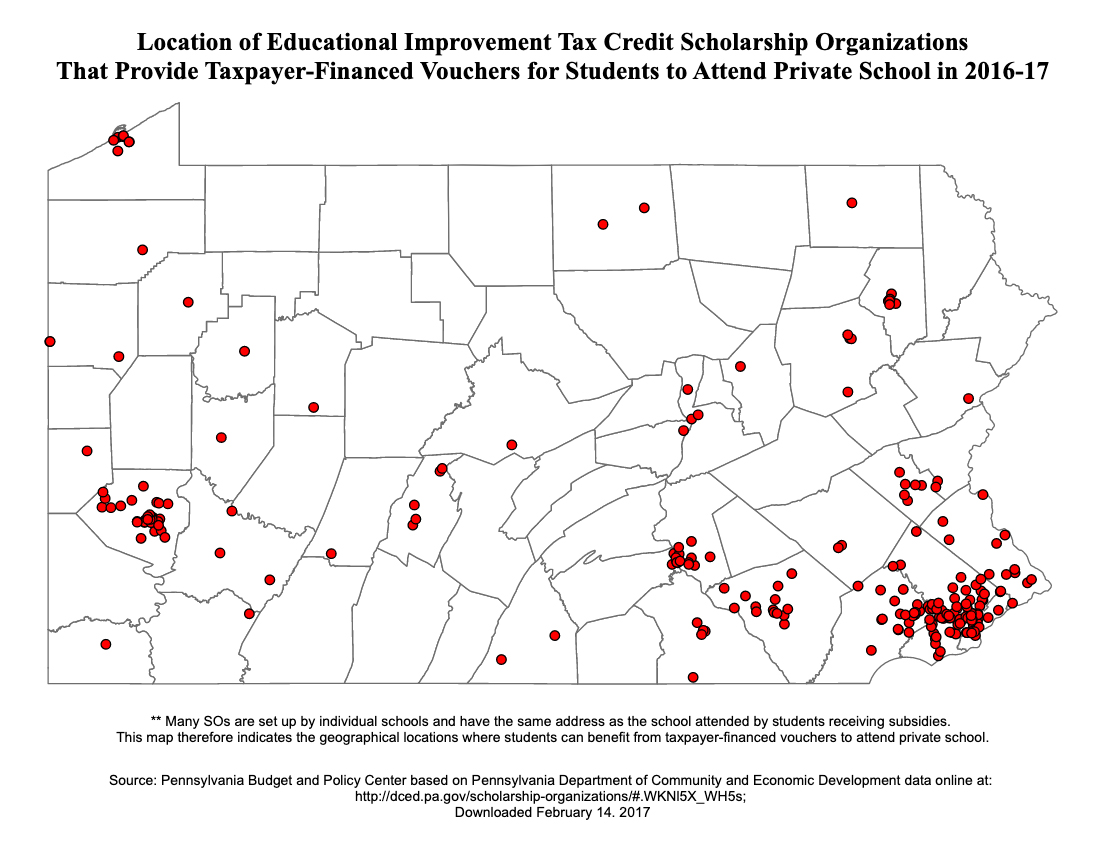

Tax Payer Funded Vouchers Education Voters Pa

Campaign Of Appreciation For Eitc Stretches From Philly To Capitol Jewish Exponent

Wonderspring Early Education Eitc Educational Improvement Tax Credit Wonderspring Early Education

Educational Improvement Tax Credit Eitc Assumption Of The Blessed Virgin Mary School West Grove Pa

Uncategorized Archives Life Swork

Pa Educational Improvement Tax Credit Program Eitc Ppt Download