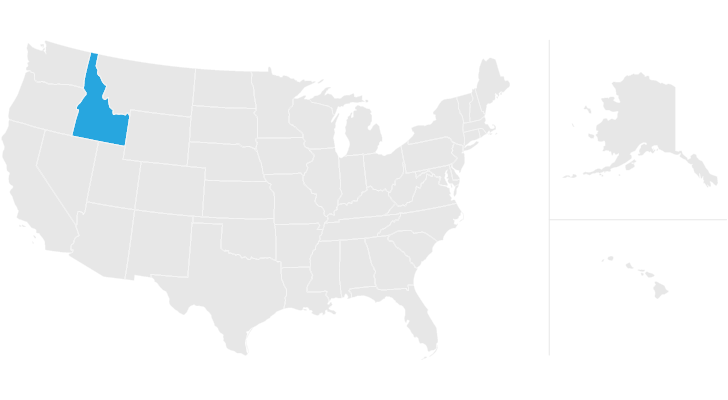

idaho state income tax capital gains

If you have a capital loss enter 0. 2022 State Capital Gains Rates Income Tax Rates and 1031 Exchange Investment Opportunities for the state of Idaho.

2022 Capital Gains Tax Rates By State Smartasset

If you make 70000 a year living in the region of Idaho USA you will be taxed 12366.

. Please refer to the individual tax return instructions for more information. Or shall own land actively devoted to agriculture as 20. Capital gains tax is a type of tax collected on.

Deduction of capital gains. 1 If an individual taxpayer reports capital gain net income in determining Idaho taxable income eighty percent 80 in taxable year 2001 and sixty. Your average tax rate is 1198 and your marginal tax rate is 22.

Net 19 capital gains treated as ordinary income by the Internal Revenue Code do not 20 qualify for the deduction allowed in this section. To qualify for the Idaho capital gains deduction a taxpayer must report capital gain net income as defined in Section 12229 Internal Revenue Code on his federal income tax. Capital gain net income is the amount left over when you reduce your gains.

IDAPA 35 IDAHO STATE TAX COMMISSION Tax Policy Taxpayer Resources Unit 350101 Income Tax Administrative Rules. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets. Idaho state sales tax rate.

Of the capital gain net income included in federal taxable income from the sale of Idaho property. Idaho State Tax Brackets. Enter your capital gain net income included in federal adjusted gross income.

To qualify for the Idaho capital gains deduction a taxpayer must report capital gain net income as defined in Section 12229 Internal Revenue Code on his federal income tax. Taxes capital gains as income and the rate reaches 660. Idaho state income tax rate.

This is the capital gain from federal Form 1040 line 7. Form 39NR Part B line 6. Taxes capital gains as income and the rate reaches 575.

The land in Utah cost 450000. Idaho state property tax rate. Featured 1031 exchange educational resources tools and replacement.

Section 63-3039 Idaho Code Rules and. The owner claims the deduction on their Idaho individual income tax return. Idaho Income Tax Calculator 2021.

Mary must report 55000 of Idaho source income from the gain on the sale of the land computed. The land in Idaho originally cost 550000. Idaho axes capital gains as income.

The 2022 state personal income tax brackets are. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

Capital Gains Tax Estimator East Idaho Wealth Management

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Historical Idaho Tax Policy Information Ballotpedia

Idaho Governor Signs 600 Million Income Tax Cut Into Law Idaho Capital Sun

Idaho Senate Passes 600 Million Income Tax Bill Without Grocery Tax Repeal Amendment Idaho Capital Sun

York Maine States Preparedness

Idaho Income Tax Calculator Smartasset

Capital Gains Tax Idaho Can You Avoid It Selling A Home

State Corporate Income Tax Rates And Brackets Tax Foundation

Homeowners In Idaho Are The Target Of A Property Tax Cut Scam Eshcinsel

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Income Tax Calculator Smartasset

Idaho Doesn T Review Its Tax Exemptions Billions Go Uncollected Annually Report Says Idaho Capital Sun

The Ultimate Guide To Idaho Real Estate Taxes