michigan property tax formula

Inflation Rate Multiplier for Capped Value Formula Announced Nov 19 2021 For property tax purposes the Michigan State Tax. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 205369 385369 145369.

Anil On Twitter States In America America States

Abbotts Sturgis Mich plant has reopened following its closure in June due to flooding.

. Summer tax mils winter tax mils total annual mils. Michigan Real Estate Transfer Tax Table - 100000 to 200000. Enter the SEV State Equalized Value found on the property tax records you will use the SEV to calculate the property taxes for a property that you are purchasing.

Here is a list of millage rates for Michigan. State Tax Day - Current S9 MichiganProperty Tax. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

The taxable value is the lesser of the assessed value or the capped value. Once you know how to find state equalized value in Michigan you can then calculate your property taxes. Learn all about Michigan real estate tax.

The application of the property tax administration fee is. View the rates below. Michigan Real Estate Transfer Tax Table - 200000 to 300000.

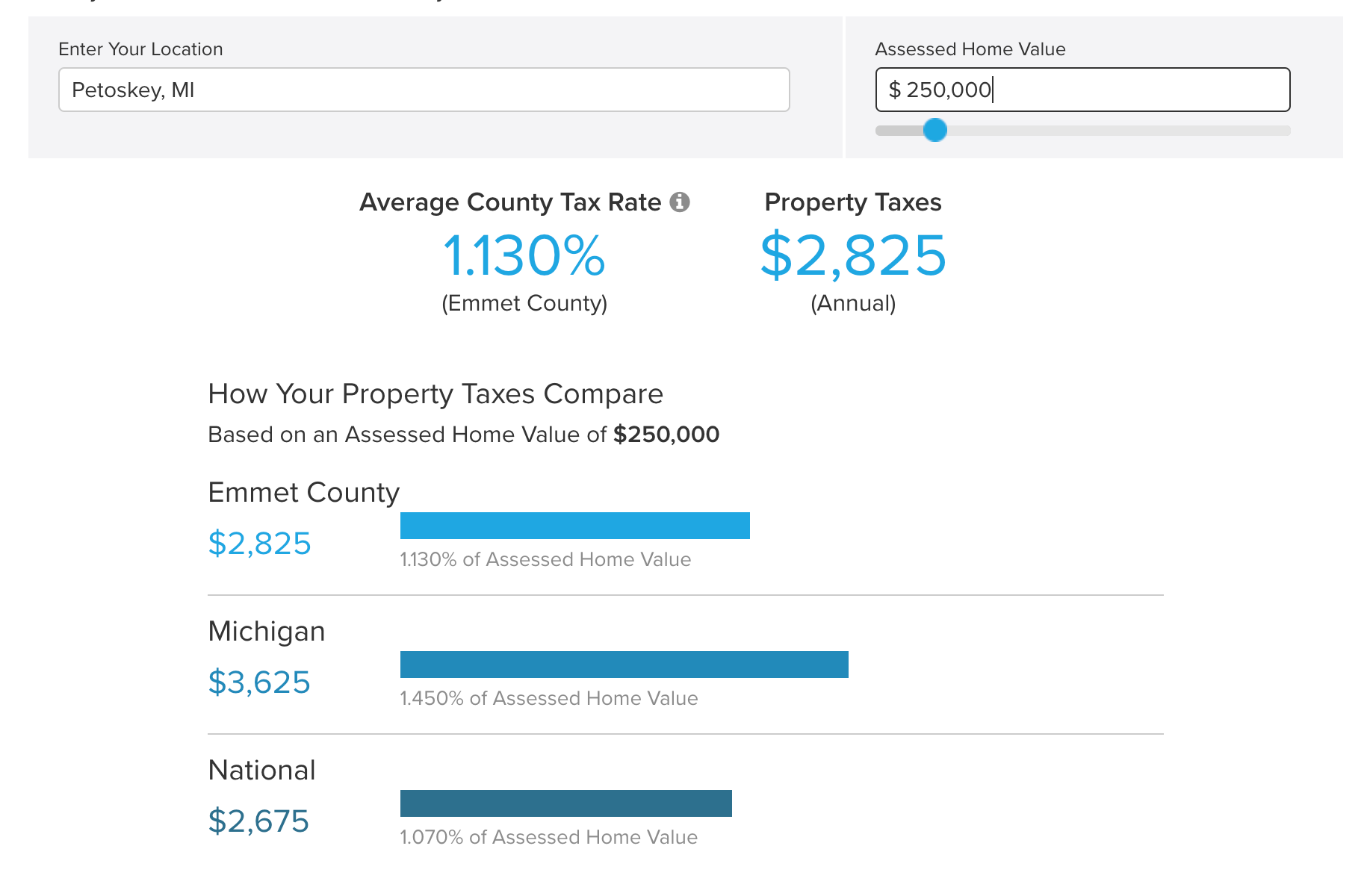

Michigan has some of the highest property taxes in the nation as measured by average effective property taxes thats total taxes paid as a percentage of the. Basic formula used to calculate a levy or property tax for one unit of government. The median property tax in Michigan is 214500 per year based on a median home value of 13220000 and a median effective.

A tax rate of 32. Beginning for calendar year 2016 the Local Community Stabilization Authority LCSA Act 2014 Public Act 86 MCL 1231341 to 1231362 requires. Whether you are already a resident or just considering moving to Michigan to live or invest in real estate estimate local property tax rates and learn.

Counties in Michigan collect an average of 162 of a propertys assesed fair. When Proposal A passed in March of 1994 it capped the amount the annual taxable value. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

In Michigan the taxable value is the figure used to calculate property taxes for the year. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY.

Millage rates can vary significantly by municipality. When comparing Michigan real property tax rates its helpful to review effective tax rates which is the annual amount paid as a percentage of the home value. The law allows for a property tax administration fee of not more than 1 of the total tax bill per parcel to apply to property taxes.

One of the nations largest suppliers of baby formula has reopened its Sturgis Mich. The Millage Rate database and. Tax Levy Millage Rate times Taxable Value.

Personal Property Tax Reimbursements. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Where to find property taxes plus how to estimate property taxes.

As Percentage Of Income. Assumptions used to create this example. Michigan Real Estate Transfer Tax Table - 0 to 100000.

How To Pick The Ideal Market For Investment Properties A Comprehensive Guide Investment Property Real Estate Investing Rental Property Investing

How To Buy Your First Multifamily Real Estate Investing Org Real Estate Tips Real Estate Investing Rental Property Real Estate Buying

State Gasoline Tax Rates By The Tax Foundation Safest Places To Travel Infographic Map Safe Cities

Property Tax How To Calculate Local Considerations

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

States With The Highest And Lowest Property Taxes Property Tax Tax States

15 Of The Cheapest Places To Buy A House In The U S Michigan City City Guide Real Estate

Here Are The U S States With No Income Tax The Motley Fool Income Tax States In America Income

What Do Your Property Taxes Pay For

Pros Cons Of Single Family Vs Multifamily Investing Real Estate Investing Real Estate Buying Rental Property Investment

Real Estate Open House Checklist Open House Marketing Etsy Open House Real Estate Open House Checklist Real Estate Checklist

Maureen Francis On Twitter Property Tax Financial Information Public School

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Retirement Retirement Advice

Inblock Management Ltd Provides Expert Property Management Solutions In Surrey And South West London En 2022 Plan De Ahorro Comprar Una Casa Gastos Personales

Bowling Green Kentucky Homes Under 250k New Mexico Homes Carlsbad Sioux Falls

Luxury Ads에 있는 Canhen님의 핀 부동산 광고 포스터 레이아웃

I Ll Buy The House If You Give Me Your Dog Aurora Sleeping Beauty Give It To Me Real Estate Agent